Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out new york?

New York State has a variety of forms that you may need to fill out depending on the purpose of your visit. For example, if you are visiting for school, you may need to fill out a student enrollment form. If you are visiting for business, you may need to fill out a business registration form. You can find the forms you need on the New York State website.

When is the deadline to file new york in 2023?

The deadline to file taxes in New York for the 2023 tax year is April 15, 2024.

New York is a state in the northeastern United States. It is the fourth most populous state and has the third-largest economy in the country. The state is known for its diverse culture, iconic landmarks such as the Statue of Liberty and Times Square, and its global influence in areas such as finance, fashion, media, and art. New York City, the largest city in the state and the United States, is often referred to as the "Big Apple" and is a major global center for finance, media, and entertainment.

Who is required to file new york?

There are several individuals and entities that are required to file taxes in New York, including:

1. Resident Individuals: Anyone who is a resident of New York State for any part of the tax year and meets the income threshold is required to file a New York State tax return.

2. Nonresident Individuals: Nonresidents who derive income from New York State sources and meet certain income thresholds must file a New York State tax return.

3. Part-Year Residents: Individuals who move in or out of New York State during the tax year, and meet certain income criteria, must file a New York State tax return.

4. Estates and Trusts: Estates and trusts that have income derived from New York State sources must file a New York State fiduciary income tax return.

5. Partnerships, S Corporations, and Limited Liability Companies: These entities are required to file various tax forms in New York State.

It is important to note that the specific filing requirements can vary depending on various factors such as income levels, residency status, and type of entity. It is recommended to consult the official guidelines provided by the New York State Department of Taxation and Finance or seek assistance from a tax professional.

What is the purpose of new york?

The purpose of New York can be understood from multiple perspectives, as it serves various purposes for different stakeholders. Here are some key purposes:

1. Economic Hub: New York is one of the world's leading financial and business centers. It houses Wall Street, headquarters of numerous multinational corporations, stock exchanges, and major financial institutions. It promotes economic growth, innovation, and global trade, attracting businesses and professionals from various industries.

2. Cultural Center: New York City is renowned for its vibrant arts and culture scene. It is home to world-class museums like the Metropolitan Museum of Art, iconic theaters like Broadway, prestigious universities, and diverse neighborhoods that foster creativity, artistic expression, and intercultural exchanges.

3. Tourism: New York is a major tourist destination, enticing millions of visitors annually. The city's iconic landmarks such as Times Square, Statue of Liberty, Central Park, and Empire State Building, among many others, attract tourists from around the globe. The entertainment, shopping, dining, and events also contribute to its popularity.

4. Education and Research: New York houses leading educational institutions such as Columbia University and New York University, as well as numerous research centers and think tanks. It plays a vital role in generating new knowledge, fostering innovation, and training future leaders in various fields.

5. Social and Cultural Diversity: New York City is known for its diverse mix of cultures, languages, and ethnicities. It serves as a melting pot, embracing different communities and providing opportunities for cultural exchange, tolerance, and understanding.

6. Political Importance: As the largest city in the United States, New York holds significant political weight. It serves as a center for political activities, hosting vital government institutions and serving as a platform for political dialogue and advocacy.

Overall, the purpose of New York can be seen as a confluence of economic, cultural, educational, touristic, and political activities, aiming to foster growth, opportunity, and global connectivity.

What information must be reported on new york?

To provide a comprehensive answer, it is important to clarify which entity or context this question is referring to. Several types of information are available and reported on New York, depending on the subject:

1. General Information:

- Geographical location: New York is a state located in the northeastern United States.

- Capital: Albany.

- Largest city: New York City.

- Official nickname: The Empire State.

- State bird, flower, and other symbols: These include the Eastern Bluebird, the Rose, and the Sugar Maple Tree.

- Population: Approximately 20 million people.

- Demographics: Information on ethnicities, languages spoken, and religious affiliations.

2. Economy:

- Major industries: Finance, healthcare, education, technology, tourism, and manufacturing.

- Gross Domestic Product (GDP) and economic indicators.

- Key economic sectors and major companies.

- Employment statistics, including unemployment rate, job growth, and workforce composition.

- Tourism data, including number of visitors and economic impact.

3. Education:

- Education system: Information on primary, secondary, and higher education institutions.

- Student enrollment statistics, graduation rates, and academic achievements.

- Education policies and reforms.

- Leading colleges and universities in the state.

4. Government and Politics:

- State government structure: Executive, legislative, and judicial branches.

- Governor and other elected officials.

- Political parties and election results.

- State budget and taxation information.

- Public policy initiatives and major legislation.

5. Health and Social Services:

- Healthcare infrastructure and facilities.

- Health statistics and public health initiatives.

- Social services and welfare programs.

- Public safety and crime rates.

- Environmental concerns and initiatives.

6. Culture and Tourism:

- Cultural institutions, museums, and landmarks.

- Festivals and events.

- Sports teams and stadiums.

- Popular tourist destinations, attractions, and accommodations.

- Cultural diversity and notable contributions.

The information to be reported on New York will vary depending on the specific purpose or context, so please provide more specific details if you are looking for information in a particular area.

What is the penalty for the late filing of new york?

The penalty for late filing of taxes in New York varies depending on the type of tax return and the amount of tax owed. However, the general penalty for late filing is 5% of the tax due for each month or fraction of a month that the return is late, up to a maximum of 25% of the tax due. Additionally, there may be interest charges on the unpaid tax amount. It is important to note that penalties and interest may vary depending on the specific circumstances, so it is always recommended to consult the New York State Department of Taxation and Finance or a tax professional for accurate and up-to-date information.

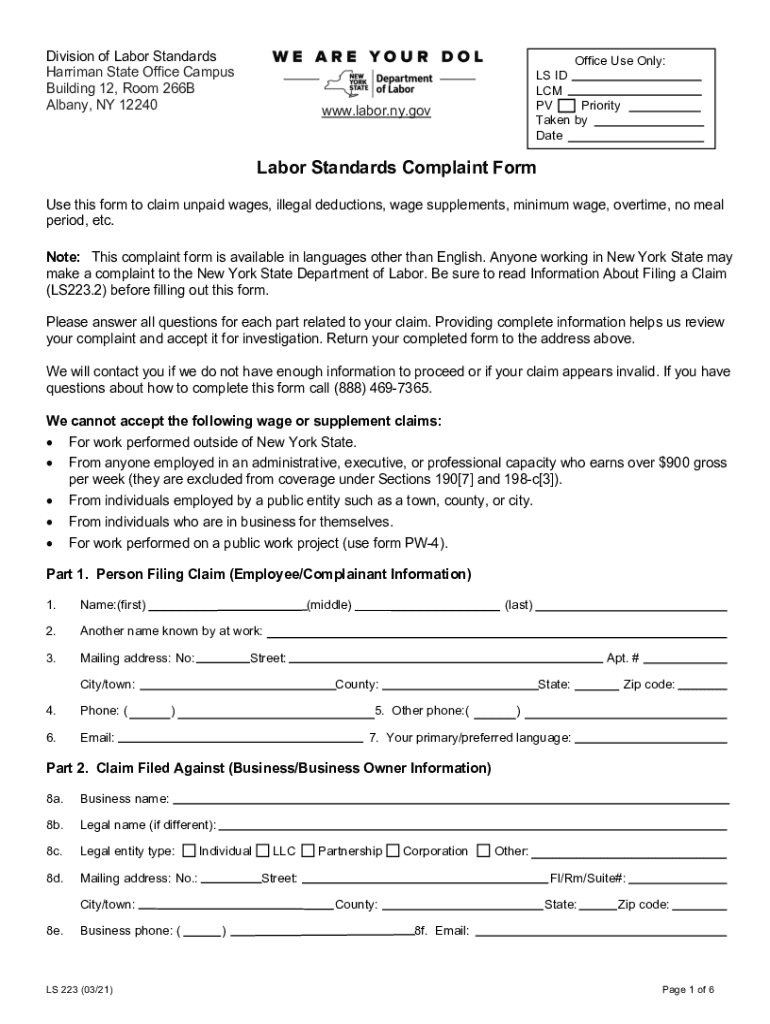

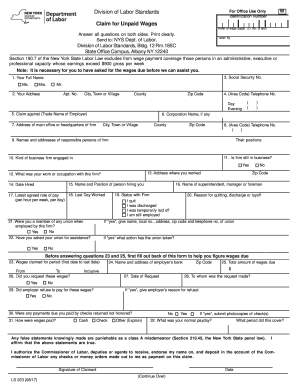

Where do I find ls223 form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ny ls223 form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete ls 223 form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your ls223. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit ls 223 nys on an Android device?

You can make any changes to PDF files, such as ny claim unpaid form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.